DOWNLOAD ENTIRE ARTICLE (with images and endnotes)

New Scholarship Programs Expand Options for N.C. Families

As school choice programs continue to increase in size and popularity, those fearing the loss of political and financial benefits reaped from the government school system have intensified their attacks. Indeed, the biggest threat to written by: school choice programs are legal attacks by government officials and their special interest allies, which are willing to go to great lengths to ensure that the public school monopoly remains the only business in town.

For example, the U.S. Department of Justice cited concerns about federal desegregation orders in their effort to block the implementation of the Louisiana Scholarship Program, a private school voucher program for low-income students who attend failing public schools. Ironically, most of the voucher recipients would be racial and ethnic minorities, the very group that the Justice Department claims to want to protect.

The Southern Poverty Law Center (SPLC) recently filed a lawsuit to stop Alabama’s tax credit scholarship program. Citing a violation of the Equal Protection Clause of the 14th Amendment, the SPLC contends that thousands of low-income children in the so-called Alabama Black Belt will not be able to take advantage of the tax credit scholarship, thus creating “two classes of students assigned to failing schools—those who can escape them because of their parent’s income or where they live and those who cannot.”

This is also a precarious time in the life of North Carolina’s newest school choice programs—Children with Disabilities Scholarship Grants and the Opportunity Scholarship Grants. Although neither scholarship program has been challenged in court, the North Carolina Association of Educators stated that they would “immediately pursue legal challenges [against] the constitutionality of taxpayer dollars to be used for private and for- profit schools.” Expect other organizations—with even deeper pockets—to join their effort to litigate school choice out of existence.

Opponents of the state’s school choice legislation suggest that the programs violate the State Constitution’s “uniformity clause,” that is, the requirement that the state provide all school-age children a uniform education. Uniformity arguments have been employed successfully in school choice lawsuits in Florida, Louisiana and Colorado. In the end, the success of North Carolina’s new scholarship programs depends on the willingness of families to champion, and if necessary defend, programs that promise to transform the lives of the state’s most vulnerable children. Comparatively speaking, the process of securing passage of the voucher legislation was the “easy” part.

For decades, the state and federal governments have provided vouchers and grants to subsidize pre-kindergarten schooling for at-risk children and postsecondary education for students who choose to attend private colleges and universities. This year, the North Carolina General Assembly added two new state-funded scholarship programs that serve low-income and special needs students in K-12 public schools.

For the Children with Disabilities Scholarship Grants, legislators set aside $3.67 million for the current school year and $4.34 million for next year to provide $3,000 per semester or $6,000 per year scholarships for students with a documented disability. Families that meet income guidelines may qualify for a maximum $4,200 per child grant under the Opportunity Scholarship Grants program. Due to logistical concerns, the $10 million program will not be available to North Carolina families until the 2014-2015 school year.

The two programs became law in very different ways.

House members Jonathan Jordan (R–Ashe), Marcus Brandon (D–Guilford), Bert Jones (R–Rockingham) and Paul Stam (R–Wake) were the primary sponsors of House Bill 269—Children with Disabilities Scholarship Grants. Bill authors introduced the legislation to replace the popular tax credit for children with disabilities that was approved in 2011. This year, the special needs tax credit was one of many state tax credits eliminated as part of the overhaul of North Carolina’s tax code. House Bill 269 received considerable bipartisan support in both the House and the Senate, and was signed into law by Governor Pat McCrory (R) on July 29, 2013.

The fight for the Opportunity Scholarship Grants was much more contentious. Not even Republican majorities in both chambers of the state legislature guaranteed passage.

House sponsors, Reps. Rob Bryan (R–Mecklenburg), Brian Brown (R–Pitt), Marcus Brandon (D–Guilford), and Edward Hanes (D–Forsyth) filed House Bill 944—The Opportunity Scholarship Act on Tax Day, 2013. Almost immediately, the mainstream media and well-funded public school advocacy groups began to exert enormous pressure on loyal Democrats and noncommittal Republicans to defeat the measure. In some respects, the N.C. Association of Educators, the N.C. Department of Public Instruction, and their ideological allies waged an effective advocacy campaign. With the exception of the Democrat bill sponsors, they ensured that the House Democrats formed a unified and vocal opposition. They also reached out to several Republican legislators with ties to the public school establishment. These legislators, which included Republicans in prominent leadership positions, appeared to slow the bill’s progress through the House.

After two dispiriting meetings of the House Education Committee, Republican support continued to waver. Democrats escalated their opposition in concert with the so-called Moral Monday protests. Concerned that the measure would not make it through votes in the House and Senate, legislative leaders took the controversial step of inserting the bill language into the state budget bill. When the Governor signed the budget on July 26, 2013, the Opportunity Scholarship Act program became law.

Due to the efforts of a handful of courageous lawmakers and a diverse coalition of school choice advocates, thousands of families will now have the means to access these new home and private school opportunities.

Now comes the really difficult part—implementation. Outside of a legal challenge, nothing will undermine a school choice program faster than sloppy administration, weak demand, and apathetic participants. That is why the rules and regulations governing the Children with Disabilities and Opportunity Scholarship laws are essential.

As the state prepares to launch both voucher programs in 2014, families interested in obtaining a scholarship for their children must first determine if they meet specific eligibility requirements outlined in the respective laws. Those general guidelines are summarized for interested families below.

Starting in the spring semester of 2014, these scholarships provide up to $3,000 per semester or $6,000 per school year for children who have a documented disability. The scholarships provide grants for tuition and special education and related services, including those services provided to home school students, at the school or facility of the parent or guardians’ choice.

The Children with Disabilities Scholarships program will replace the state’s Tax Credits for Children with Disabilities approved in 2011. This is a significant “win” for North Carolina families, as the tax credit was dependent on the tax liability of the filer. Under the previous tax credit plan, the typical family was able to claim an average of $2,400, a sum that did little to meet the needs of most of the 700 families that claimed the credit in its first year. Those with no tax liability, which includes most low-income households, could not claim a tax credit because the credit was not refundable. State legislators were sensitive to these concerns and designed the new scholarship plan to resolve them.

Eligibility: Scholarship recipients must have been enrolled in a North Carolina public school during the semester before enrollment at the nonpublic school, received special education services in an N.C. public preschool, received a special needs scholarship grant the previous semester, or will enter kindergarten or first grade. Note that the child must meet one, not all, of the above requirements.

All eligible children must have an Individualized Education Plan (IEP), receive special education services regularly, and be under 22-years-old in order to qualify for a scholarship. In addition, the child does not qualify for a scholarship if he or she had been placed in a private or non-profit facility at public expense, graduated from high school, or attended a postsecondary institution as a full-time student.

Administration and Regulation: The North Carolina State Education Assistance Authority (NCSEAA)—not the N.C. Department of Public Instruction or the Division of Non-Public Education—will administer and regulate the program for the state. The NCSEAA oversees a number of programs “designed to help North Carolinians meet the cost of higher education.” In addition to disseminating information about financial aid programs available for students who attend North Carolina colleges and universities, the NCSEAA also administers North Carolina’s “529” National College Savings Program and the state’s Federal Family Education Loan Program. Starting in 2013, the agency will add a K-12 education component to their work.

Each year, NCSEAA officials will make applications available no later than May 1 for the fall semester and October 1 for the spring semester. Parents or guardians will be notified in writing no later than July 1 for the fall semester and December 1 for the spring semester.

Prioritizing Applicants: Families with a child who has received a scholarship or tax credit will receive priority for a scholarship the following years, so long as the child continues to meet all eligibility requirements. The NCSEAA will award additional scholarships in the order of eligible applications received until available funds are exhausted. The law requires the state to make any unexpended funds available to award scholarship grants to eligible students.

Verification: The families of scholarship recipients are required to submit receipts to the NCSEAA to verify expenditure of the grant. The agency also requires verification of enrollment at the nonpublic school or, in the case of home school families, receipt of special education services for 75 days or more during the semester. Failure to provide this documentation may lead to the revocation of the scholarship. The program requires the NCSEAA to ensure that the local school district reevaluates the child at least every three years to verify the child’s disability.

Beginning in the fall of 2014, certain families across North Carolina will have access to a nonpublic (private) school scholarship of up to $4,200 per year. The actual amount awarded cannot exceed the actual cost of the standard tuition and fees charged by the nonpublic school of choice. As outlined below, year 1 and year 2 eligibility requirements differ in important ways. The goal of this design was to ensure that the program enrolled low-income families initially and then expanded eligibility to both low- and middle-income families in subsequent years.

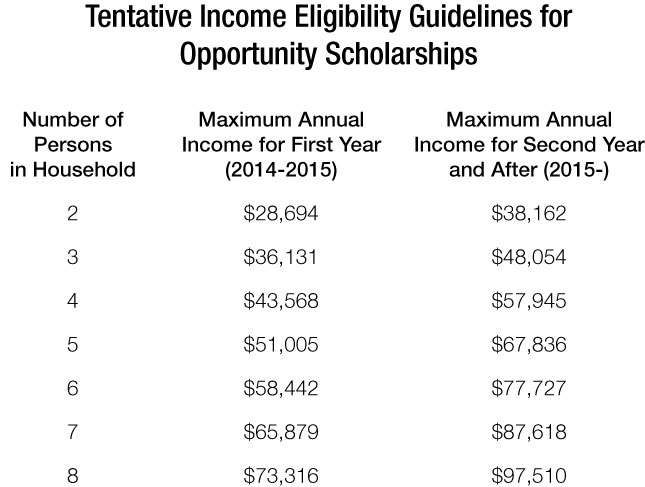

Eligibility: Year 1 The first year of the program (2014-2015) has eligibility requirements that may not apply to subsequent years. For the first year, all children must reside in a household that has an income that does not exceed the amount required for the student to qualify for the Federal Free and Reduced Lunch (See Table above, first column). For a family of four, the total annual household income cannot exceed $43,568, for example. In addition, the child must be a full-time student at a public school during the spring semester of 2014 and may not be a high school graduate. If the number of applicants exceeds the number of scholarships available, the North Carolina State Education Assistance Authority (NCSEAA) may select students using a random lottery system.

Eligibility: Year 2 and After For subsequent years of the program (2015 and after), the program’s eligibility requirements have additional components. Similar to the first year requirements, the child may not be a high school graduate. Additionally, he or she must meet one of five additional requirements in order to be eligible for a scholarship. The applicant must be a full-time student at a public school during the previous semester, a scholarship recipient during the previous school year, entering kindergarten or first grade, in foster care, or a child whose adoption decree was entered less than a year prior to applying for the scholarship.

Income: Most significantly, the income eligibility jumps to 133 percent of the amount required for the student to qualify for the Federal Free and Reduced-Price Lunch Program (See Table on page 15, last column). This raises the income eligibility significantly, allowing middle-income families to qualify. Under this standard, a family of four may have an annual household income of up to $57,945. This is more than $14,000 higher than the first year income limit.

While income eligibility becomes more generous in the second year of the program, there is a “skin in the game” requirement, depending on income level. The law mandates that only 90 percent of the standard tuition and fees of the school of choice (up to $4,200) may be awarded to children who reside in families that have an annual income between 100 percent and 133 percent of the amount required for the student to qualify for the Federal Free and Reduced-Price Lunch Program.

Administration and Regulation: NCSEAA officials will make applications available no later than February 1 for fall semester enrollment. Parents or guardians will be notified of their decision by March 1. Families who received a scholarship during the previous school year will receive priority, so long as the student continues to meet all eligibility requirements. After the NCSEAA distributes scholarships to prior recipients, the agency must award at least half of the remaining scholarship funds to students in households who have an income that does not exceed the amount required for the student to qualify for the Federal Free and Reduced Lunch (See Table on page 15, first column). In addition, the law caps the percentage of funds that may be awarded to students entering kindergarten or first grade at 35 percent.

The NCSEAA sends a check directly to the nonpublic school, but the nonpublic school cannot deposit the funds until a parent or guardian of a scholarship recipient goes to the school and endorses the scholarship in person. First and foremost, this requirement serves a legal purpose. But the symbolic significance of this act cannot be overstated.

Verification: Similar to those who receive a special needs scholarship, families of Opportunity Scholarship recipients are required to submit receipts and documentation required by the NCSEAA. Failure to do so may lead to revocation of the scholarship.

During the school year, the agency will evaluate a random sample of scholarship households to ensure that income requirements are met. In addition, the NCSEAA may access relevant information held by other state agencies.

The state legislature does not appropriate funds for the 2015-2016 and 2016-2017 school years until they meet to approve a new biennial budget in 2015. As a result, it is impossible to predict how much funding will be available for the second year of the Opportunity Scholarship Grants and third year of the Children with Disabilities Scholarship Grants. Even slight changes in party membership, composition, and/or leadership may lead to significant changes to funding levels, as well as program rules and regulations.

School choice supporters learned one important lesson during the debates over these voucher programs—even solid Republican majorities in the state House and Senate do not guarantee that any school choice measure will pass easily. Those fortunate families who receive scholarships, as well as those citizens and policy leaders who will fight to grow them, must not take any thing or any one for granted. North Carolinians must not allow these school choice programs to end before they begin.

DOWNLOAD ENTIRE ARTICLE (with images and endnotes)

Terry Stoops, Ph.D. is director of education studies at the John Locke Foundation.